Alex Tuch, the Buffalo Sabres and why signing bonuses could impact his next contract

The market could demand that the Sabres change their typical contract structure or risk losing an important player.

Alex Tuch has a chance to hit the market on July 1 as one of the top free agents available. Ben Ludeman / NHLI via Getty Images

The 2026 NHL free agency class is thinning rapidly, and that could give Buffalo Sabres forward Alex Tuch a chance to hit the market as one of the top free agents available on July 1. And while it’s difficult to predict exactly what Tuch’s next contract could look like in a rising salary-cap environment, the recent deals signed by the league’s top stars indicate that Tuch should expect — and even demand — a contract loaded with signing bonuses.

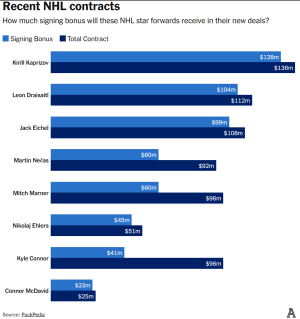

Since late September, Jack Eichel, Kyle Connor, Martin Nečas, Kirill Kaprizov and Connor McDavid have signed contract extensions. And while each of those players was in a slightly different negotiating position, big signing bonuses were the common denominator in all of them.

Those five players were scheduled to become unrestricted free agents next summer, and all signed contracts with more than 40 percent of the contract’s total value allocated as signing bonuses. For the top three contracts in terms of average annual value (Kaprizov, Eichel and McDavid), more than 90 percent of the total money is in signing bonuses.

This is a continuation of a trend that started about a decade ago, slowed down coming out of COVID and has accelerated again in recent years. Mitch Marner and Leon Draisaitl both received bonus-heavy deals. So did Nikolaj Ehlers when he became the top free agent left standing last summer.

As one agent put it, “If one elite player gets it, the next elite players want it, too. It’s like a merit badge.”

Why does this matter? From a team perspective, it matters because it matters to players. Signing bonuses were once something a team like the Toronto Maple Leafs did more frequently than any other team. Now, most of the top teams in the league that are spending to the cap are structuring contracts to be signing-bonus heavy. It can be a competitive advantage because players want their contracts with as much signing bonus as possible.

Getting a lot of signing bonus is about more than just vanity for players, too. For players who are older when signing a contract, getting most of the money in signing bonuses makes the contract buyout-proof to an extent. When buying out a player’s contract, a team can only save a third of the remaining salary on the deal. Signing bonuses are guaranteed even if a player is bought out. Take the contract Ehlers signed in Carolina. He has an $8.5 million cap hit for six years, but his salary in each year of the contract is only $1 million; the rest is paid out in signing bonuses. If three years into that contract, he’s not worth that cap hit, the Hurricanes wouldn’t have much incentive to buy him out because the savings would be minuscule.

A related but less important factor is that signing bonuses are paid in the event of a lockout, while salaries are not. The new NHL collective bargaining agreement (CBA), which was agreed upon by the league and the players' association in June, runs through the 2029-30 season. All of the extensions listed above will run beyond that season, so those players will get paid whether the NHL has a lockout in 2030 or not.

The other reason players and their agents like to have a lot of signing bonus is because it’s better to get as much money as soon as possible rather than spread it out over the course of a deal. Accounting for inflation and the ability to invest that money, $10 million today is worth more than the same $10 million a year from now.

As an example, Eichel's new contract starts on July 1, 2026. He’ll get a $16.85 million signing bonus check on that day. He’ll receive $850,000 in salary spread out as game checks throughout the season. And then he’ll receive another $16.8 million signing bonus payment on July 1, 2027. So in the first calendar year of his contract, Eichel will make $34.5 million. Without any signing bonus in his contract, Eichel would have received $13.5 million over the course of the first calendar year of that deal. Invested properly, he will make more money on this contract because it hits his bank account sooner. Depending on the market and a player's offseason living situation, taxes can affect signing bonuses, but that's a smaller consideration for players.

In exchange for getting so much in signing bonus, players will often be willing to take less money on the average annual value of the contract. That helps the team lower the cap hit and create more cap space.

However, when the new CBA kicks in on Sept. 16, 2026, signing bonuses will be capped at 60 percent of a contract's total value. Because cash flow is not equal for every NHL franchise, teams willing to pay most of a contract in signing bonuses were viewed as having a potential competitive advantage.

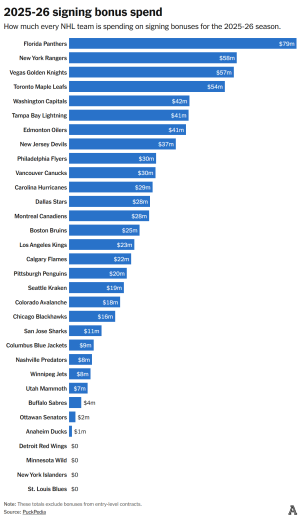

A quick look at which teams spend the most on signing bonuses helps explain why that fear exists. With the rising salary cap, there has been some concern about a widening gap between the haves and the have-nots around the NHL. That’s already showing up based on which teams have the willingness and ability to frontload contracts with signing bonuses.

PuckPedia provided data on which teams are spending the most on signing bonuses this season, excluding entry-level contracts. Of the teams spending less than $20 million on signing bonuses this year, only the Colorado Avalanche and Winnipeg Jets are serious Stanley Cup contenders. And the Avalanche just gave Nečas $60 million in signing bonuses, while the Jets gave Connor north of $40 million in bonuses in his new deal. These are teams willing to meet the market demand.

That's where Tuch's situation comes into focus. He and the Sabres have engaged in contract discussions but couldn’t come to an agreement before the start of the season. They recently put talks on the back burner to focus on the season. Tuch grew up two hours away from Buffalo, cheering for the Sabres. He's been an asset to the locker room and the community while scoring 36 goals in a season twice and playing a consistent two-way game. He was also the key piece of the trade that sent Eichel to Vegas. To say Tuch has leverage would be an understatement.

Buffalo is also one of the teams that spends the least on signing bonuses in the NHL. Since the pandemic-shortened season, when Terry Pegula said the goal was to be effective, efficient and economic, the Sabres have been stingy with bonus money. Rasmus Dahlin got $5 million total on an $88 million contract, or 5.6 percent of the deal. Big money long-term extensions for Tage Thompson (4 percent signing bonus), Dylan Cozens (4 percent signing bonus) and Owen Power (3.6 percent signing bonus) followed a similar structure.

“It’s something we’ve thought a lot about,” Sabres general manager Kevyn Adams said before the season. “I mean, ultimately everybody’s got a little bit of a different philosophy in how they do things but when we started signing now a few years ago some of those extensions or longer term contracts we kind of had a template that we used, whether it was trade protection or you saw probably some of those deals with a signing bonus in year one but then flat structure after. We just feel that makes most sense for us but ultimately they’re going to end up with the same money in a year so it’s not … For us, I understand why other teams do it, but that’s for — internally we’ve had a lot of discussions on this, that’s just the structure we’ve landed on that makes the most sense.”

The market could demand that the Sabres change that structure or risk losing an important player. This season, the Sabres have just over $4 million in signing bonuses on the books when you don’t account for entry-level contracts. But the Sabres now have a different situation with Tuch. Unlike the others who signed big deals in Buffalo, Tuch is staring down unrestricted free agency and not restricted free agency. That gives him more leverage. He’s also going to be 30 when his next contract starts, so he has more incentive to want the deal to be as buyout-proof as possible.

But unlike those teams you see at the top of the list for signing bonus spending, the Sabres aren’t flush with cash. Fourteen straight years without the playoffs have put a strain on attendance and revenue. The Tuch contract negotiations will be a test of what the Sabres are willing to spend.

“It wouldn’t be a dealbreaker if that’s what you’re asking,” Adams said when asked if the Sabres are willing to bend on signing bonuses for players who want it. “But we have an internal structure that we’ve had that works for us. Rasmus Dahlin was similar when he signed his extension, and so that’s something we’ve stuck with. But no, there’s never been any sort of conversation, if that’s what you’re getting at, like ‘Oh, we can’t do this, we can’t do that.’ We want to put the best team together we can possibly put. We’re always keeping an eye on the marketplace and other contracts that are signed, we understand how that works across the league, but we just want the best players we can and get them done.”

The Jets had to deviate from their typical contract structure to retain Connor, who also could have become an unrestricted free agent. Like Buffalo, Winnipeg isn’t one of the most cash-rich teams in the NHL. That’s why the Jets are a bit more reluctant to hand out large chunks of signing bonus. But as one agent put it, “there’s always a player who becomes an exception.”

Will Tuch be that exception for the Sabres?